Modigliani Miller Traditionelle These | Https Www Hsu Hh De Infi Wp Content Uploads Sites 702 2018 06 Gfin Folien Mm Ft 18 Pdf

Grundlagen der Investitionsrechnung 51 Verfahren der Investitionsrechnung 511 Statische Verfahren 512 Dynamische Verfahren 513 Interner Zinsfuß 514 Dynamische Amortisationsrechnung 6. Authors where some of these investigations found some different and opposite findings of Modigliani-Miller 1958 theorem.

Http Www Raute De Inhalt Downloads Begin Id 255

The pure Modigliani and Miller theory is an ideal case that does not apply to the real world.

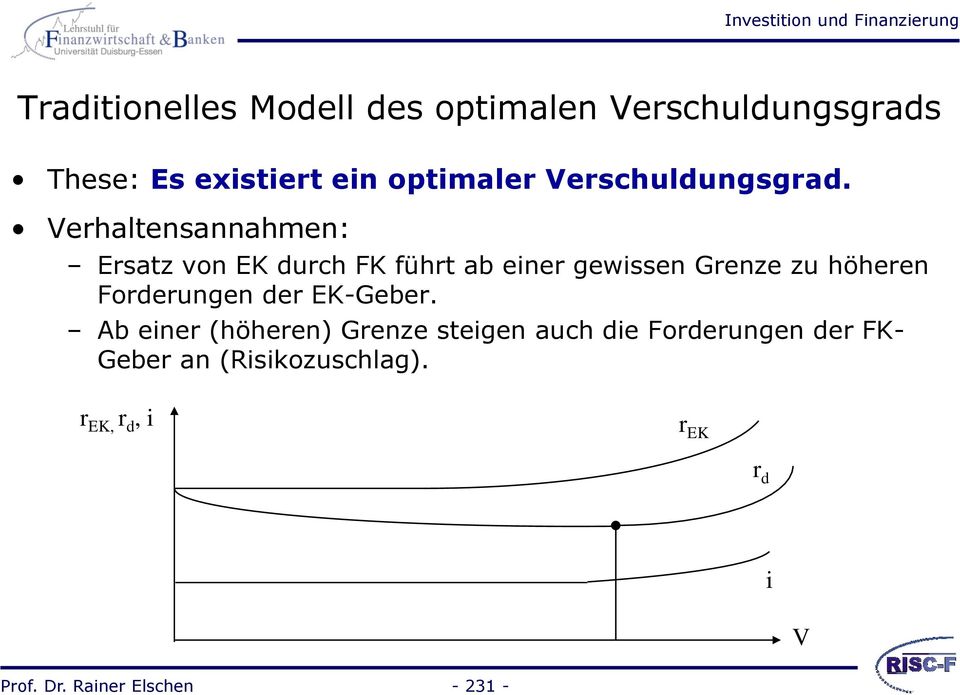

Modigliani miller traditionelle these. Das Modigliani-Miller-Theorem zeigt nun gerade dass auf dem vollkommenen Kapitalmarkt im Gleichgewicht der Eigenkapitalkostensatz nicht einmal im Bereich sehr geringer Verschuldungsgrade annähernd konstant ist und hat insofern die traditionelle These abgelöst. THEORY OF INVESTMENT 263 as large and as direct an influence on the rate of investment as this analysis would lead us to believe. Therefore certain modifications had been made in the theory in order to make it practical.

Because some studies next to the issuance of Modigliani-Miller theorem announced different findings than than that of Modigiani-Miller more studies for different firms and. Cest pourquoi Modigliani et Miller vont prendre en compte la fiscalité pour savoir si celle ci va modifier les conclusions du premier modèle. Some of these changes were made by Modigliani and Miller themselves while the rest were applied by other economists.

The Modigliani-Miller theorem a foundation of modern corporate finance basically states that in a no-frictions world two identical firms have the same enterprise value regardless of their financial structure. Given a firm A whose liabilities are 50 equity and 50 debt and a firm B which is financed 100 by equity the value of firm A and the value of firm B are the same. The legal professions lack of familiarity with these Nobel Prize-winning authors and their work is not merely an oversight.

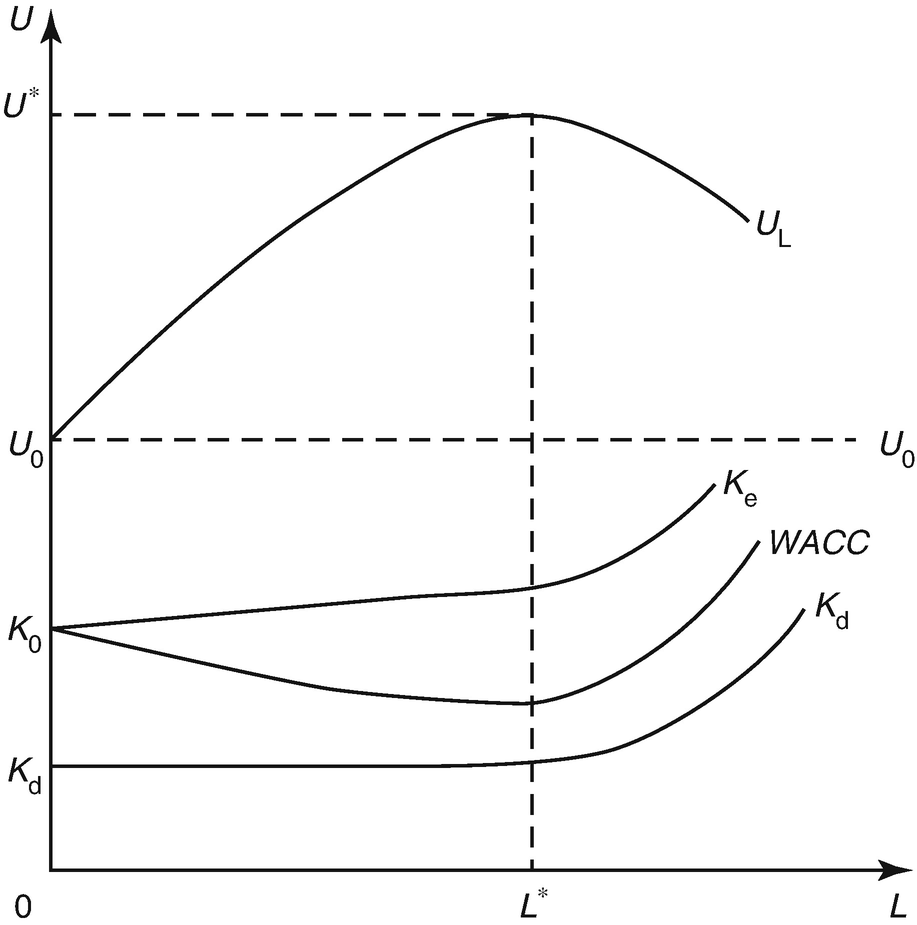

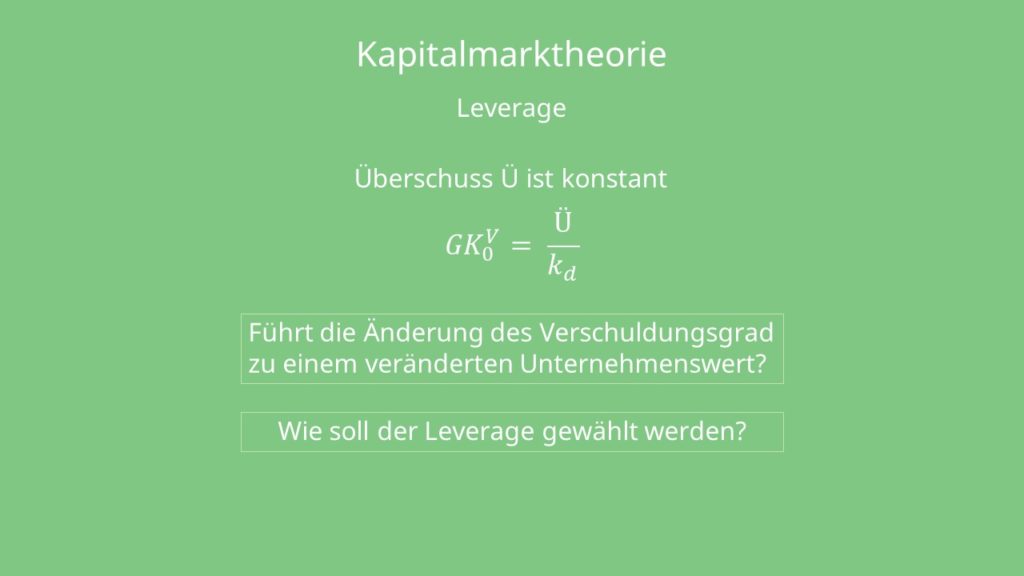

Referat Investitions- Kapitalstrukturrisiko Leverage-Effekt und die optimale Verschuldung. Profitant de déséquilibres sur le marché financier que Modigliani et Miller considèrent comme injustifiés. 471 Traditionelle These 472 Modigliani Miller These.

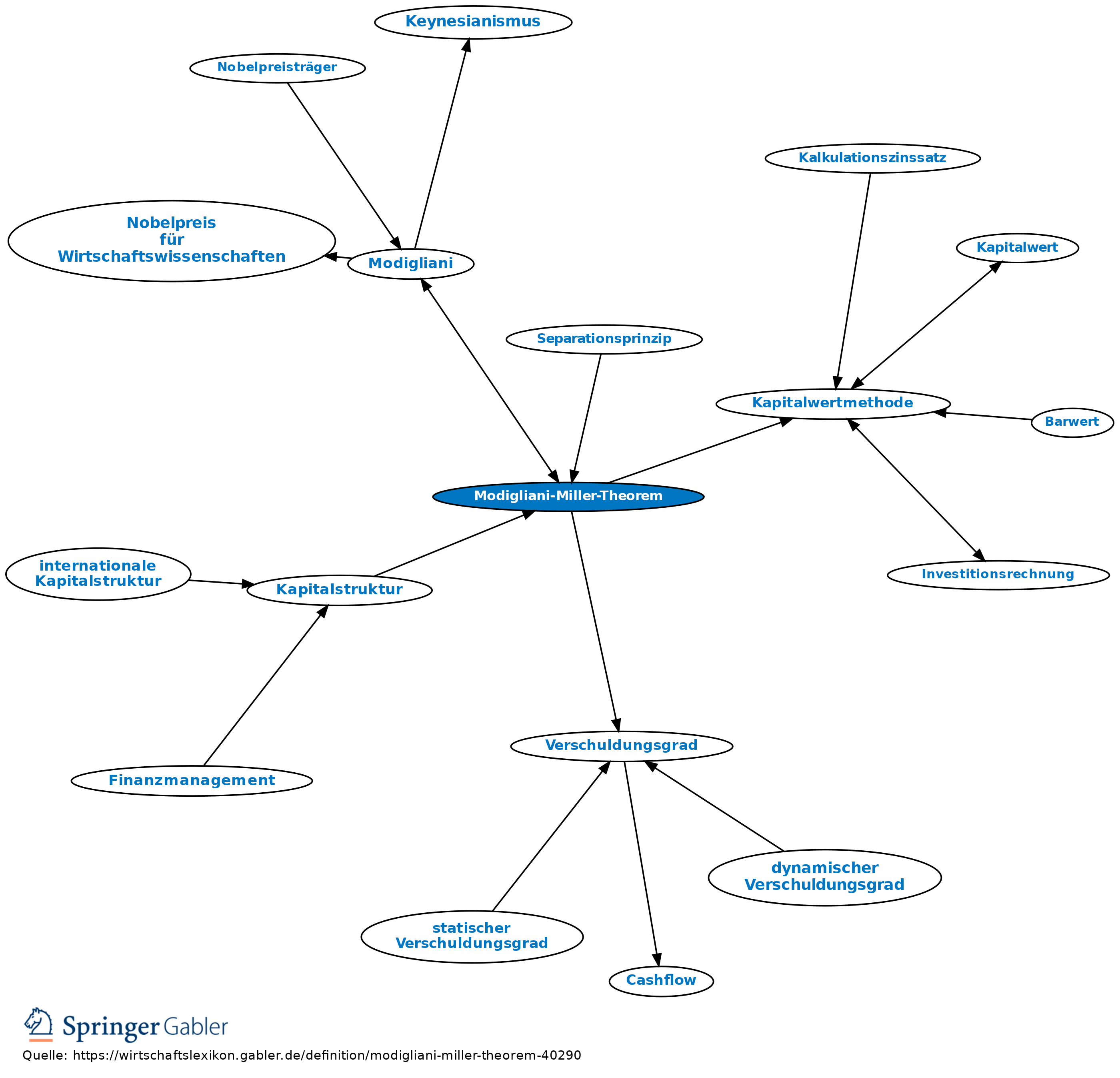

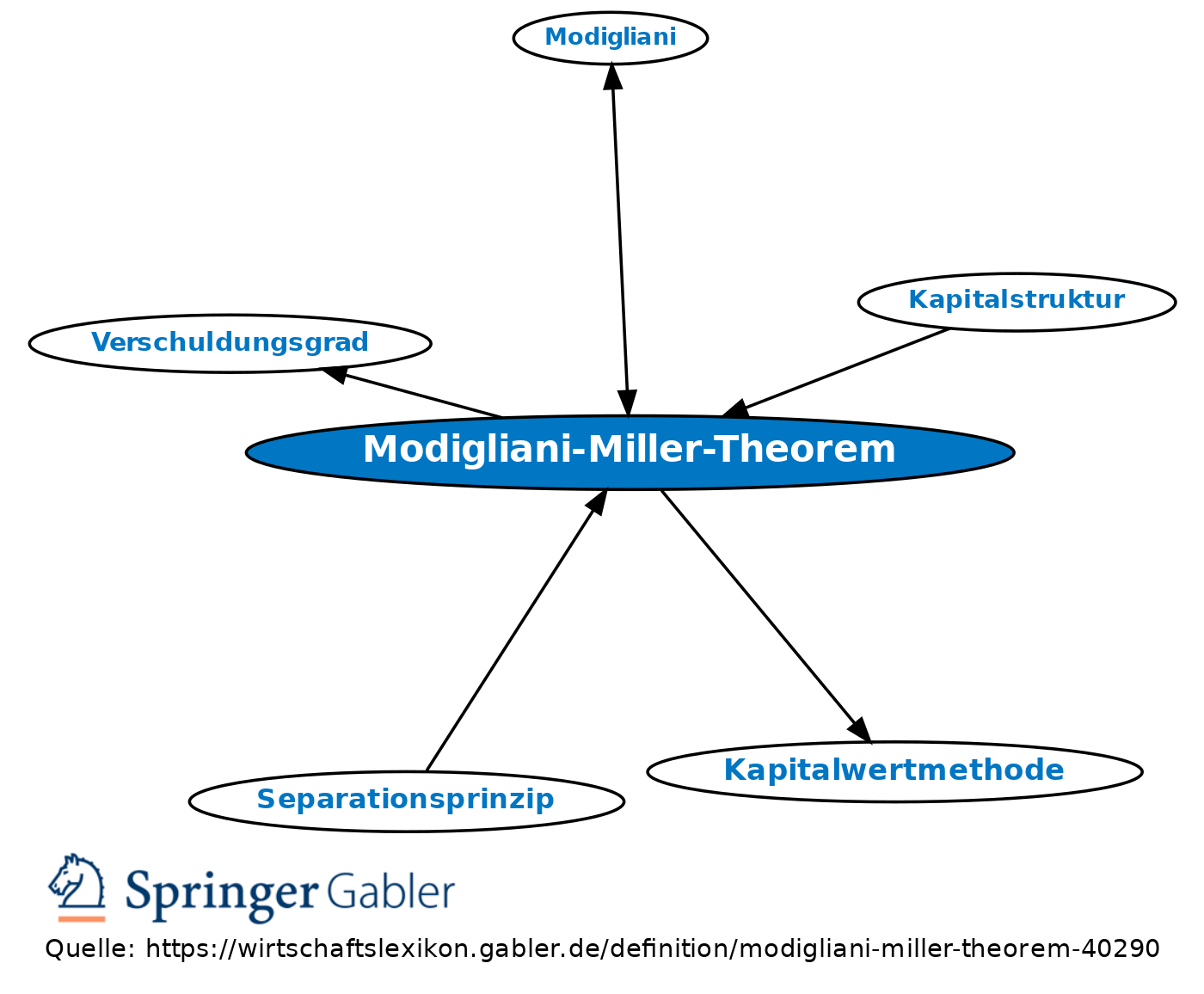

Das Modigliani-Miller-Theorem basiert auf der Annahme eines. The MM Theorem or the Modigliani-Miller Theorem is one of the most important theorems in corporate finance. Franco Modigliani und Merton H.

The theorem was developed by economists Franco Modigliani and Merton Miller in 1958. Kapitalmarktorientierte Bewertung von EK und FK erfolgt nicht 14 Irrelevanzthese zur Kapitalstruktur von ModiglianiMiller Vollkommener Kapitalmarkt. It is a missed opportunity.

Lactionnaire de la Sté dont la valeur est la plus forte va céder ses actions pour devenir actionnaire de la Sté qui a la valeur la plus faible en espérant bénéficier à titre personnel dun effet de levier favorable. This approach was devised by Modigliani and Miller during the 1950s. When inverted the Modigliani-Miller theorem describes the mechanisms through which capital structure can affect value.

Die traditionelle These zur optimalen Kapitalstruktur. Miller haben diese These in ihrem vielbeachteten Aufsatz 1958 vgl. The Modigliani-Miller theorem states that in the absence of taxes bankruptcy costs and asymmetric information and in an efficient market a companys value is unaffected by how it is financed regardless of whether the companys capital consists of equities or debt or a.

Modigliani and Miller Approach. There is n o dependence between the value o f the f irm and f irm costs of capital to its capital. Modigliani and Miller in their article 1958 and illustrated by B ose 2010 are.

Modigliani and Miller advocate capital structure irrelevancy theory which suggests that the valuation of a firm is irrelevant to the capital structure of a company. III- La prise en compte de la fiscalité et la modification des conclusions La fiscalité va remettre en cause la neutralité des financements. The fundamentals of the Modigliani and Miller Approach resemble that of the Net Operating Income Approach.

At the microeconomic level the cer-tainty model has little descriptive value and provides no real guidance to the finance. Modigliani and Miller Approach of Capital Structure also known as the MM Approach is an important revolution in the capital structure theories. The main idea of the MM theory is that the capital structure of a company does not affect its overall value.

The chairman and CEO of Legg Mason Capital Management an investment management firm with over 60 billion under management. Über den Marktwert von Finanztiteln auf Sekundärmärkten 13 Traditionelle These zur Kapitalstruktur Die traditionelle These.

Amazon Com Kapitalstrukturrisiko Und Arbitrageprozesse Die Modigliani Miller These Zur Optimalen Kapitalstruktur German Edition Ebook Heidrich Chris Sebastian Kindle Store

Modigliani Miller Theorem Wikipedia

Capital Structure Modigliani Miller Theory Springerlink

Modigliani Miller Theorem Definition Gabler Wirtschaftslexikon

Http Www Stendal Hs Magdeburg De Project Konjunktur Fiwi Vorlesung 7 Semester Vorlesungsmaterial Thema 2016 20modigliani Pdf

Kapitalstruktur Traditionelle These

Kapitalstruktur Traditionelle These

Kapitalmarkt Und Optimaler Verschuldungsgrad Verstandlich Erklart Mit Video

Duale Hochschule Baden Wurttemberg Villingen Schwenningen Fakultat Wirtschaft Studiengang Bwl Bank Diskussionsbeitrage Pdf Free Download

Kapitalmarkt Und Optimaler Verschuldungsgrad Verstandlich Erklart Mit Video

Capital Structure Modigliani Miller Theory Springerlink

Verschuldungsgrad Richtig Verstehen Sicher Anwenden

Modigliani Miller Theorem Definition Gabler Wirtschaftslexikon

Http Content Grin Com Document V200270 Pdf

Kapitalstrukturrisiko Und Arbitrageprozesse Die Modigliani Miller These Zur Optimalen Kapitalstruktur German Edition Ebook Heidrich Chris Sebastian Amazon Co Uk Kindle Store

Http Content Grin Com Document V200270 Pdf

Kapitalstruktur Traditionelle These

Https Www Hsu Hh De Infi Wp Content Uploads Sites 702 2018 06 Gfin Folien Mm Ft 18 Pdf